| Author |

Message |

sportsnut

Citizen

Username: Sportsnut

Post Number: 850

Registered: 10-2001

| | Posted on Friday, January 16, 2004 - 2:48 pm: |     |

http://www.cnn.com/2004/US/01/16/2003.taxes.ap/index.html

I especially like this paragraph:

Tax advisers at Petz Enterprises Inc., which runs the online tax preparation service TaxBrain, said they expect 10 million households run by married couples whose incomes range from $47,000 to $65,000 to be among the biggest winners. The combination of new tax rates and tax cuts targeted at married couples will move many of those households from the 27 percent bracket down to the 15 percent bracket.

I am surprised that the ultra wealthy beneficiaries of the Bush tax cuts only earn $65K per year. |

bobk

Supporter

Username: Bobk

Post Number: 4340

Registered: 5-2001

| | Posted on Friday, January 16, 2004 - 2:51 pm: |     |

Sports I doubt if the ultra-wealthy use Petz for their tax work.  |

cjc

Citizen

Username: Cjc

Post Number: 734

Registered: 8-2003

| | Posted on Friday, January 16, 2004 - 2:58 pm: |     |

I'll just send mine into the deserving coffers of Maplewood and Essex County. |

tjohn

Citizen

Username: Tjohn

Post Number: 2079

Registered: 12-2001

| | Posted on Friday, January 16, 2004 - 2:59 pm: |     |

What is the deal with the AMT. I understand that amid all the yakking about tax cuts, the AMT is biting an increasing number of essentially middle-class people. |

tom

Citizen

Username: Tom

Post Number: 1795

Registered: 5-2001

| | Posted on Friday, January 16, 2004 - 3:00 pm: |     |

Biggest winners among who? If anyone's interested in doing the math, as opposed to the same old cheerleading, there's a cool calculator at http://www.responsiblewealth.org/tax_fairness/2003TaxCut.html |

jfburch

Citizen

Username: Jfburch

Post Number: 1233

Registered: 6-2001

| | Posted on Friday, January 16, 2004 - 3:14 pm: |     |

See also:

Perfectly Legal: The Covert Campaign to Rig Our Tax

System to Benefit the Super Rich - and Cheat Everybody Else

by David Cay Johnston |

sportsnut

Citizen

Username: Sportsnut

Post Number: 851

Registered: 10-2001

| | Posted on Friday, January 16, 2004 - 3:28 pm: |     |

Tjohn - we had a very enlightening discussion about that very topic about a month ago. I think there were some figures that if the AMT exemptions are not adjusted due to inflation the percentage of taxpayers subject to the AMT would grow to somewhere about 20-25%. My point in that discussion was that the AMT is a creditable tax and that you may take it as a credit against your regular tax in any year in which your regular tax exceeds your AMT.

tom - cool site. I'm saving (based on estimates) approx $4,500. After which I have to subtract any AMT which is not factored into that site. Based on my calculation that would drop my tax benefit down to around $2,800, which on a percentage basis is not that great. Not bad, but not great. |

lumpyhead

Citizen

Username: Lumpyhead

Post Number: 623

Registered: 3-2002

| | Posted on Friday, January 16, 2004 - 3:41 pm: |     |

What would be an equitable way to tax people of different incomes, a flat tax or do you think the percentage should rise as your income rises? Is the intent to punish people who "make too much money" or just to be fair to all? |

Dave Ross

Citizen

Username: Dave

Post Number: 6133

Registered: 4-1998

| | Posted on Friday, January 16, 2004 - 3:51 pm: |     |

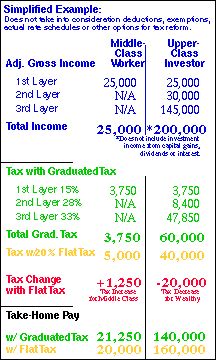

quote:Simplified hypothetical example:

Let's examine a hypothetical example of a true flat tax (we have to use a hypothetical example because none of the actual proposals is a true flat tax) and compare it with a simplified example of a hypothetical progressive system. Let's imagine a progressive system with three rates: 15% on the first $25,000 income layer, 28% on the next $30,000 layer (from $25,000 to $55,000) and 33% above $55,000. A person who earns $25,000 would be entirely in the first 15% layer, for a tax of $3,750. His take-home pay is $21,250. A flat 20% rate would raise the working guy's taxes by $1,250.

A person earning $200,000 (the wealthiest 2% of the population) pays an exactly equal $3,750 for the first $25,000 layer. For the layer from $25,000 to $55,000 he pays the 28% tax of $8,400; and for the final $145,000 layer he pays the 33% tax of $47,850 for a total tax of $60,000. His take-home pay is $140,000 -- more than six times that of the $25,000 worker. With a flat 20% rate the investor's taxes would go down by $20,000!

|

sportsnut

Citizen

Username: Sportsnut

Post Number: 852

Registered: 10-2001

| | Posted on Friday, January 16, 2004 - 3:52 pm: |     |

tom - just curious is Petz Enterprises, Inc. affiliated with the republican party? Judging by your response about cheerleading you must know something we don't.

That website also proves that the more you make the more you'll save. Which on its face seems fair since most of you would clearly argue that when taxes are raised the more you make the more you should pay. Why does it only go one way?

lumpyhead - personally, I don't think a flat tax is the way to go. A progressive tax rate is fairer, up to a point. Is it fair that a person who is successful forfeit over 40% of their salary (federal and state/local taxes). I think the answer is no and that is why I support the cuts (although contrary to what most would think I am curious about the timing.) |

bobk

Supporter

Username: Bobk

Post Number: 4343

Registered: 5-2001

| | Posted on Friday, January 16, 2004 - 5:23 pm: |     |

One of the things most tax comparisons don't take into account is the Social Security Tax. When this is factored in I have seen charts that show we pretty much have a flat tax rate already. I will search for the chart and try to post it on Saturday.

|

Sylad

Citizen

Username: Sylad

Post Number: 150

Registered: 6-2002

| | Posted on Friday, January 16, 2004 - 8:00 pm: |     |

I will use it to fund a trip to D.C. to lobby for the overturning of the 22nd amendment. |

Mayhewdrive

Citizen

Username: Mayhewdrive

Post Number: 708

Registered: 5-2001

| | Posted on Friday, January 16, 2004 - 8:10 pm: |     |

Sylad,

You'll be about 4 years too late.  |