| Author |

Message |

themp

Citizen

Username: Themp

Post Number: 1379

Registered: 12-2001

| | Posted on Wednesday, January 26, 2005 - 10:23 am: |

|

The Bush administration plans on "cutting the deficit in half in five years", right? So how come that isn't expressed anywhere in specific terms? Like "this means in year X, the deficit will be $Y"? If I said "I'm going to double my income in five years", it would mean in 2010, I'd be earning 2 times my present salary and I could express this aspiration in numbers. Just curious. I'm sure that it has been made literal somewhere, so why isn't that substituted for the vague language by both the press and the administration? It's like saying "the US has more than four dozen states" or something.

|

Robert Livingston

Citizen

Username: Rob_livingston

Post Number: 757

Registered: 7-2004

| | Posted on Wednesday, January 26, 2005 - 10:29 am: |

|

Here's an interesting article on Bush's fiscal failures written by conservative commentator Pat Buchanan.

Buchanan: "Today, America is a country that cannot say no. The backslapping of Republicans notwithstanding, we do not have a true or tough conservative in the Oval Office. There is no conservative party in Washington. And we shall pay a historic price for it."

MORE:

"From every standpoint, America is a nation over-extended, living beyond its means, mortgaging its future for the present."

|

tulip

Citizen

Username: Braveheart

Post Number: 1981

Registered: 3-2004

| | Posted on Wednesday, January 26, 2005 - 10:33 am: |

|

He won't talk in precise answers. He will only state and restate generalizations. I do apologize to the Bush supporters who read this and are offended by it, but this kind of behavior is really not democratic. The people need to have specifics, not just hash and re-hash such as "the people need to be able to manage their own money." We need specifics. We just do. We need to know if it was the financing of the war that meant we'd have this crisis in social security. We need to know what "math" he is talking about. Otherwise, the message as someone said on the message board earlier is, "trust us, we know what we're doing. Do it our way and you'll be fine." How is that democracy? The people have to decide on issues, and selecting a leader democratically does not mean selecting a blanket set of policies. |

overtaxdalready

Citizen

Username: Overtaxdalready

Post Number: 336

Registered: 6-2001

| | Posted on Wednesday, January 26, 2005 - 11:05 am: |

|

Themp,

Here's an article from today's WSJ that discusses changes to the deficit in the coming years.

It skips the obligatory Bush and Republican-bashing while presenting the CBO's case for changes in the deficit.

"In our continuing quest to save readers' time, we suggest you skip all of those alarmist stories in today's newspapers about the latest federal budget deficit estimates. They will have you believing that the feds are starved for cash, which defies everything we've ever learned about the way government works.

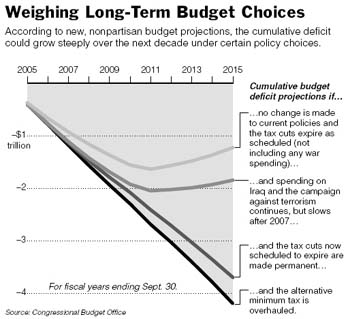

All you really need to know about the latest Congressional Budget Office figures is contained in the nearby chart. The darker bars at the bottom measure the annual budget deficit as a share of the U.S. economy, showing that it will steadily decline throughout the rest of this decade. From 3.6% of GDP in the 2004 fiscal year, the deficit will fall steadily to an insignificant 0.5% of GDP in 2011, assuming continued economic growth.

We realize these CBO estimates don't include future spending on the war in Afghanistan and Iraq. But as CBO points out, revenues are expected to grow rapidly over the decade, especially in individual income taxes. The progressive nature of the U.S. tax code means that, as growth raises incomes, more and more people are pushed into higher tax brackets, even if President Bush's tax cuts are made permanent.

Budget estimates beyond the current year are always a guess, and CBO's is hardly more educated than others, but the larger point of these numbers is that with even a modicum of spending restraint the federal deficit will fall back to zero over the next few years.

The other thing to know is revealed in the lighter bars in the chart, which show debt held by the public as a share of GDP. This is the most telling measure of the federal debt burden because it indicates a country's ability to service that debt. And the chart shows the U.S. burden staying more or less constant through this decade despite the fact that annual deficits will add to the total amount of debt.

Even at 38.6% of GDP in 2006, debt held by the public would remain well below the 49.4% level hit in 1993, the most recent peak year. And it would also be well below the general government debt burden in Germany (51.9% of GDP), France (42.7%) and especially spendthrift Japan (79.3%), according to statistics from Bear, Stearns & Co. Compared with other industrial nations, in short, the U.S. is in strong fiscal shape.

Bear, Stearns economist David Malpass adds the cheeky point that, despite its high debt burden, Japanese interest rates are close to zero. This would tend to refute the claim -- made so often by politicians who want to raise taxes -- that deficits cause higher interest rates. Robert Rubin, call your press agent.

It is also true that these debt figures do not include the future liabilities for Medicare and Social Security that politicians have promised. But Congressman John Spratt (D., S.C.) and other self-described "deficit hawks" could raise taxes beyond their wildest dreams and never raise enough revenue to pay for those promises. The only way to reduce those liabilities is to reform those entitlement programs -- for example, with private Social Security accounts that will build wealth over time. Any politician who moans about the "deficit" or the "national debt" and opposes entitlement reform is really arguing for a tax increase."

|

themp

Citizen

Username: Themp

Post Number: 1380

Registered: 12-2001

| | Posted on Wednesday, January 26, 2005 - 11:38 am: |

|

"This would tend to refute the claim -- made so often by politicians who want to raise taxes -- that deficits cause higher interest rates. Robert Rubin, call your press agent."

Is that claim only made by politicians? Just curious.

Didn't republicans used to want something called "The Balanced Budget Amendment" or something? Why'd they want it for? Didn't the almost pass it in 1997?

Who's this guy who did this testifying? Is he some clown?

Statement of

Robert D. Reischauer

Director

Congressional Budget Office

before the

Subcommittee on Deficits, Debt Management and International Debt

Committee on Finance

United States Senate

June 5, 1992

Mr. Chairman and Members of the Subcommittee, I appreciate the opportunity to appear here to discuss how budget deficits affect long-term economic growth.

The Congressional Budget Office agrees with the Government Accounting Office and most economists that large persistent federal deficits dampen the rate of productivity and economic growth. Ultimately, deficits of the sort this country has experienced for over a decade keep living standards from attaining the level they could reach if the deficits were smaller. The problem is all the more pressing because the deficits occur at a time when other factors--low private saving rates, the slow growth in productivity, and demographic trends--will also tend to restrain the improvement of living standards.

Policymakers as well as economists widely recognize these arguments. But recognizing and understanding a problem is not the same as doing something about it: after more than two decades of discussion and procedural changes, we still do not have either agreement on the policy changes necessary to cut the deficit or the procedures that will effectively bring about a budget close to being balanced.

|

Rastro

Citizen

Username: Rastro

Post Number: 644

Registered: 5-2004

| | Posted on Wednesday, January 26, 2005 - 12:01 pm: |

|

overtaxed,

That sounds suspiciously more like an editorial than an article. No? |

TomR

Citizen

Username: Tomr

Post Number: 460

Registered: 6-2001

| | Posted on Wednesday, January 26, 2005 - 1:03 pm: |

|

Just food for thought:

If the deficit is reduced by 50% over the next five fiscal years, won't that still lead to an increase in the national debt of about two trillion dollars to nine and a half trillion?

Does anybody have a resource for projections of our gross domestic product over the next five years?

TomR

|

themp

Citizen

Username: Themp

Post Number: 1384

Registered: 12-2001

| | Posted on Wednesday, January 26, 2005 - 1:13 pm: |

|

I'm thinking more about that WSJ "article" and its conclusion is rather breathtaking. Only "politicians who want to raise your taxes" think that deficits need to be avoided, so once you eliminate those folks from consideration, you are left with no real objections to deficits.

Dick Cheney has denied saying "Reagan proved deficits don't matter" as quoted by Paul O'Neill, but if this WSJ article is true, he needn't have. I think we are seeing the right lay the groundwork for coming out of the closet on this issue. They are now disseminating the argument that deficits actually don't harm the economy. Soon maybe they will all publicly embrace that idea on a stage with vats of Kool-aid nearby. Will posters on this board obediently imbibe? |

themp

Citizen

Username: Themp

Post Number: 1385

Registered: 12-2001

| | Posted on Wednesday, January 26, 2005 - 2:18 pm: |

|

"Today's WSJ lead editorial is a classic. It's titled "All you need to know", and shows the CBO projection of declining deficits and stable debt. What they either don't know or believe readers don't know is that this is the *baseline* projection, which assumes that the sunset clauses in the tax cuts actually go into effect, with the whole thing expiring at the end of 2010 (which is halfway through fiscal 2011, in their chart.) It also assumes that nothing is done to reform the alternative minimum tax, which amounts to a stealth tax increase. So what they've proved is that the tax cuts are affordable as long as they go away ..." Krugman

Checkmate. |

themp

Citizen

Username: Themp

Post Number: 1386

Registered: 12-2001

| | Posted on Wednesday, January 26, 2005 - 2:21 pm: |

|

|

|